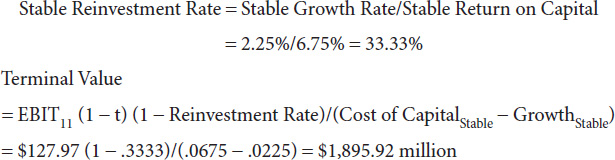

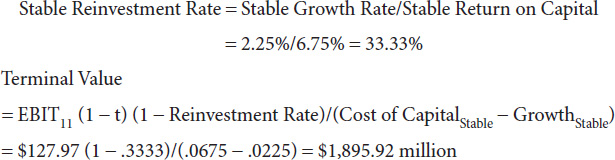

Reinvestment rate formula

Now that we have the Year 2 terms we can calculate the reinvestment rate. Add the Money invested.

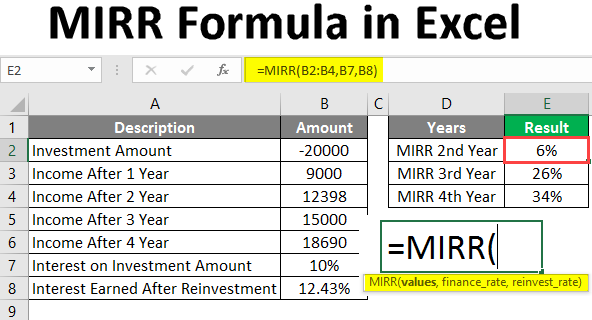

How To Use The Excel Mirr Function Exceljet

The MIRR formula used by firms and investors in capital budgeting is as follows.

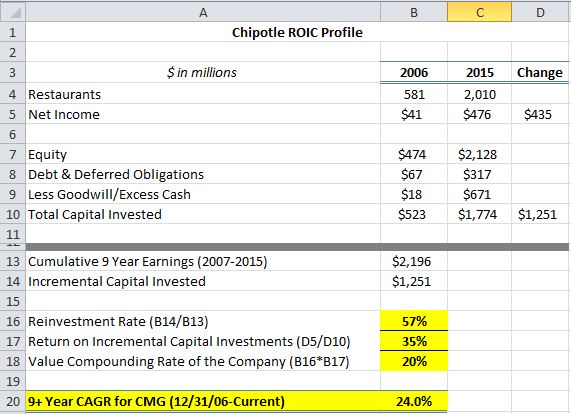

. ROIC stands for Return on Invested Capital and is a profitability or performance ratio that aims to measure the percentage return that a company earns on invested capital. The formula for the cash reinvestment ratio requires you to summarize all cash flows for the period deduct dividends paid and divide the result into the incremental increase. Then subtract non-cash sales 30000 and dividends.

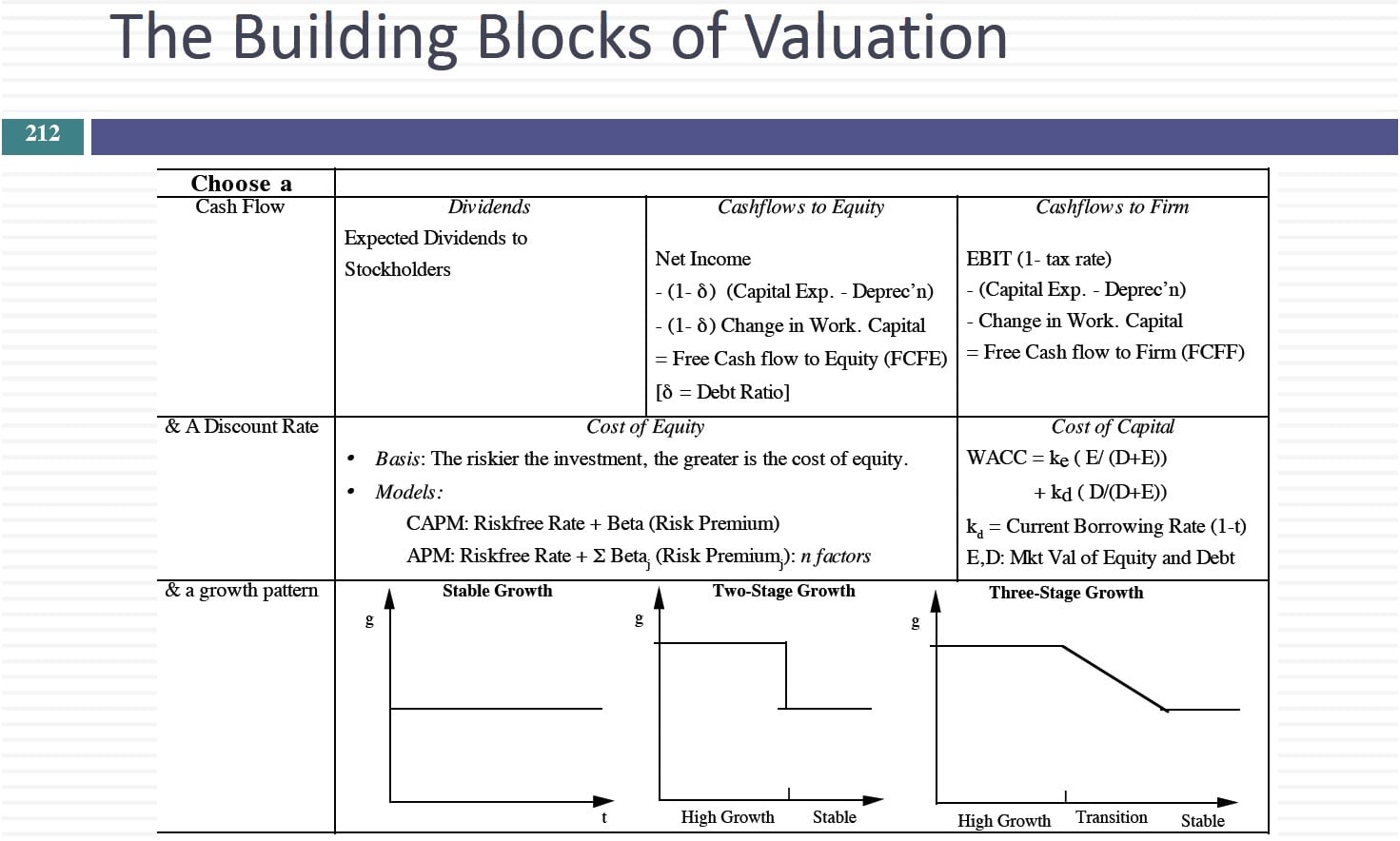

Reinvestment risk is the risk that future coupons from a bond will not be reinvested at the prevailing interest rate from when the bond was initially purchased. The formula for calculating the reinvestment rate is shown below. Here this step helps you to choose how much money you want to invest in a stock.

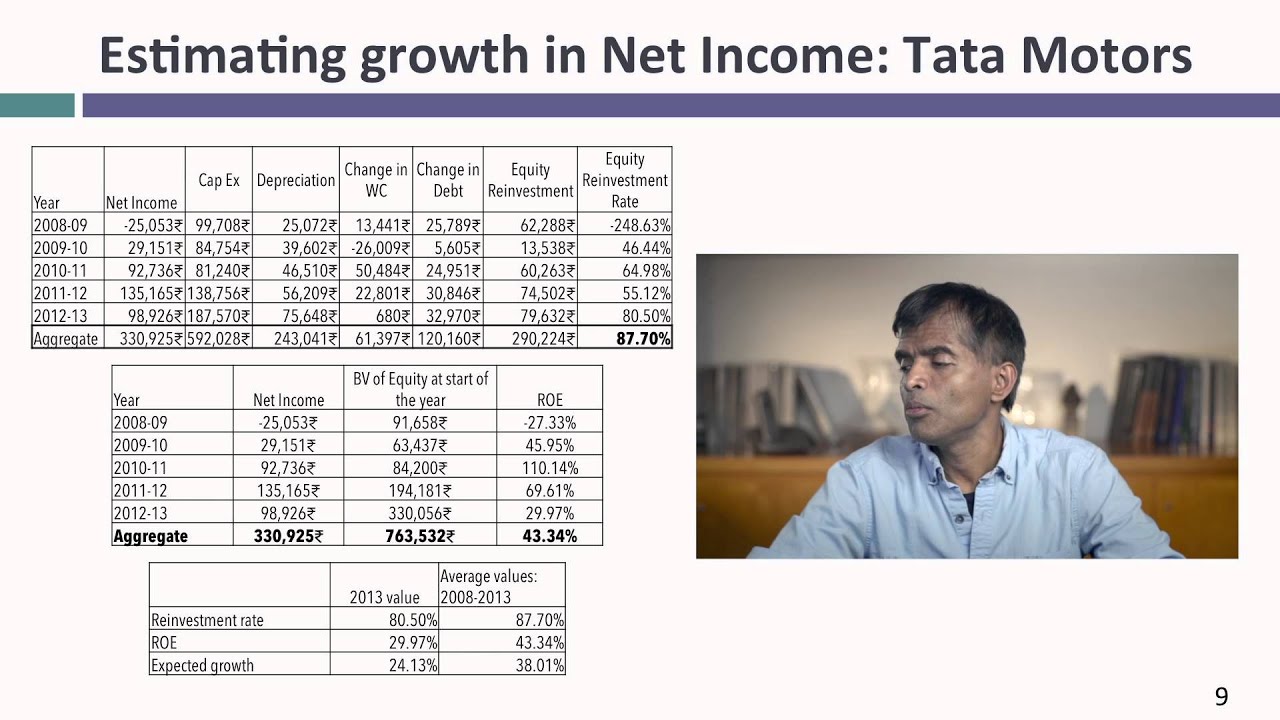

Here are a few major steps to use the Dividend Reinvestment Calculator. Many people will set the expected growth rate but will fail to project the corresponding reinvestment rate over the stable growth period. Reinvestment rate 900000 100000 9600000 104.

The financial management rate-of-return formula still assumes Ryan will reinvest the entire 300 per month. The life of the investment is 7 years so lets look at what each. The reinvestment rate for the.

Experimentation to Find the Right Reinvestment Rate Once the data has been collected and a. Although this is a good place to start it is not necessarily the best estimate of the future. To calculate the reinvestment rate simply divide the total amount of cash flow that was reinvested back into the investment by the total amount of cash flow generated by the.

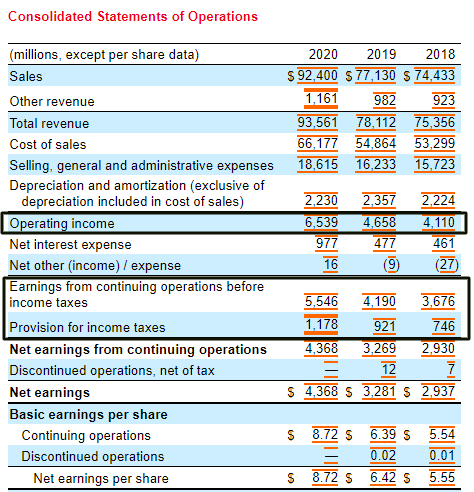

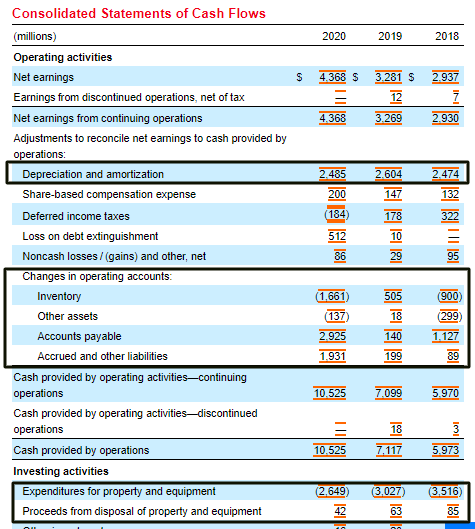

Net CapEx CapEx Depreciation. Since we set the reinvestment rate for MIRR to 0 we can make an extreme example to illustrate the point. To calculate the adjusted cash flow we can add non-cash expenses 168000 and the net income 6023000.

The formula assumes a reinvestment rate of 15 percent which is highly unlikely. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals.

Reinvestment Rate Net CapEx Change in NWC NOPAT. A casinos player reinvestment rate on a monthly basis. NOPAT EBIT.

Where FVCF Future cost of the positive cash flows after deducting the reinvestment rate or cost of capital. When the calculated IRR is higher than the true reinvestment rate for interim cash flows the measure will overestimatesometimes very significantlythe annual equivalent. This is illustrated in Table 1.

The reinvestment rate is often measured using the most recent financial statements for the firm.

Why Net Depreciation From Capex For Computing Reinvestment Rate

How To Use Reinvestment Rate To Project Growth For Valuation

Corporate Valuation Free Cash Flow Approach Ppt Download

Reinvestment Rate Formula And Calculator

Session 10 Growth Rates Terminal Value Model Choice Youtube

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

The Light Side Of Valuation How To Value Growth Companies Informit

How To Use Reinvestment Rate To Project Growth For Valuation

Mirr Formula In Excel How To Use Mirr Function With Examples

Reinvestment Rate Formula And Calculator

Myth 5 3 Growth Is Good More Growth Is Better By Aswath Damodaran Harvest

Level I Cfa Tutorial Fixed Income Reinvestment Assumption In Calculating Yield To Maturity Ytm Youtube

Calculating The Return On Incremental Capital Investments Saber Capital Management

Firm Valuation A Summary Ppt Download

Reinvestment Rate Terminal Value Model Choice

Session 31 Cash Flows Growth Rates Youtube

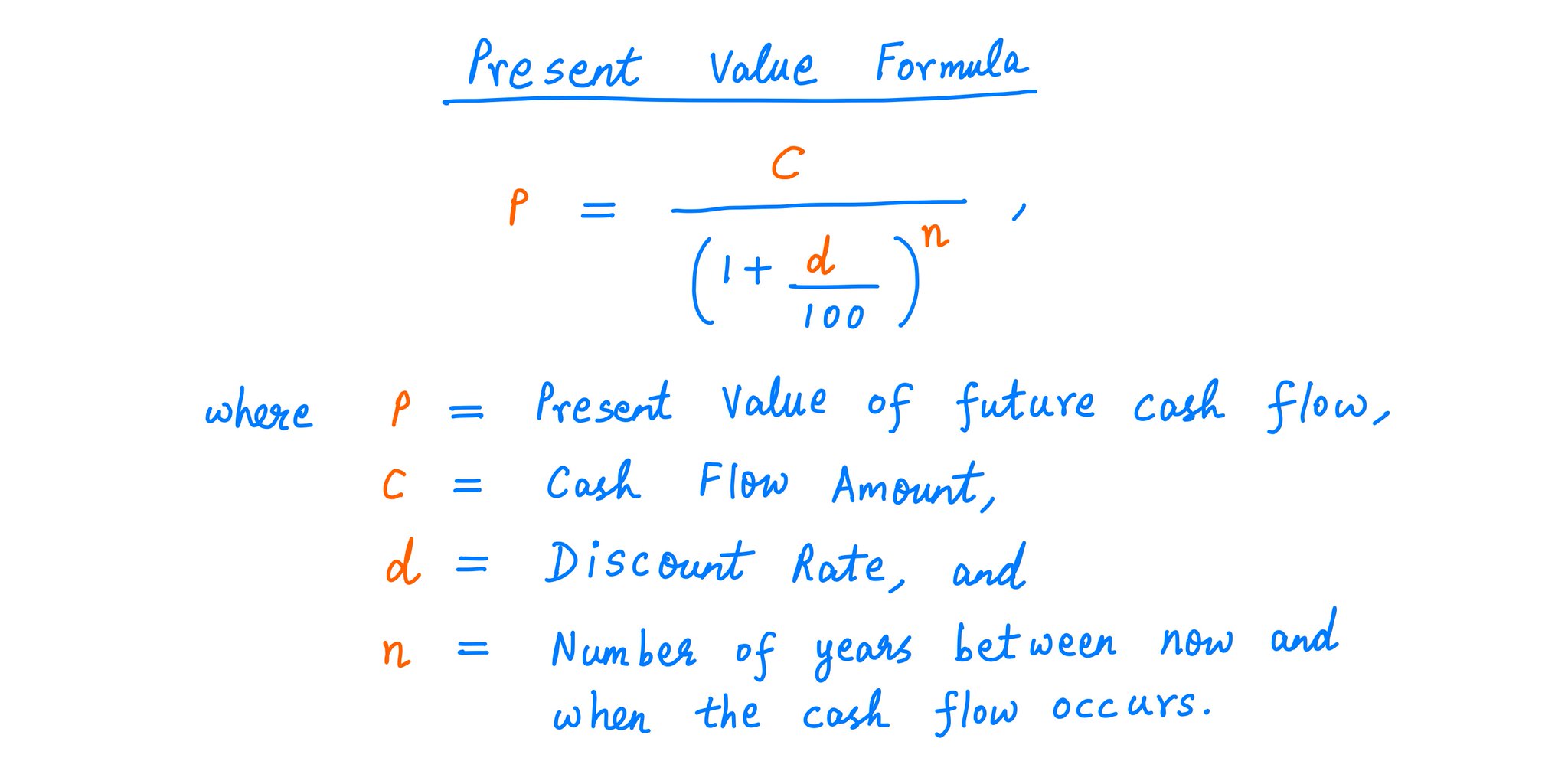

10 K Diver On Twitter 13 Here S A Formula To Calculate The Present Value Of A Future Cash Flow Along With A Couple Examples As You Can See The Formula Takes A Cash